… to Hide an 8,500,000 Dollar Real Estate Deal to Avoid paying taxes? It certainly looks that way!

We are reporting what we believe is a coordinated effort to evade paying taxes on a multi-million-dollar real estate transaction between the leaders of the Chicago Teachers Union and the development company Sterling Bay.

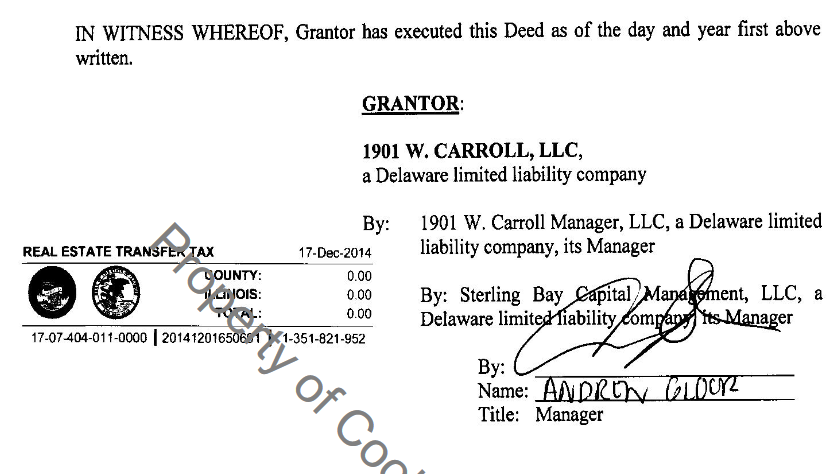

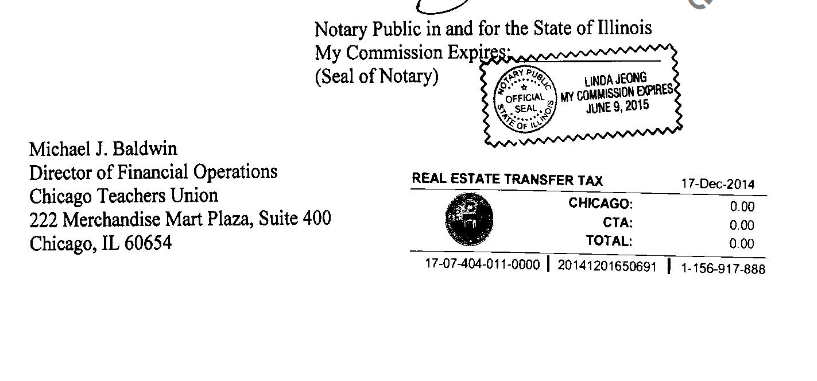

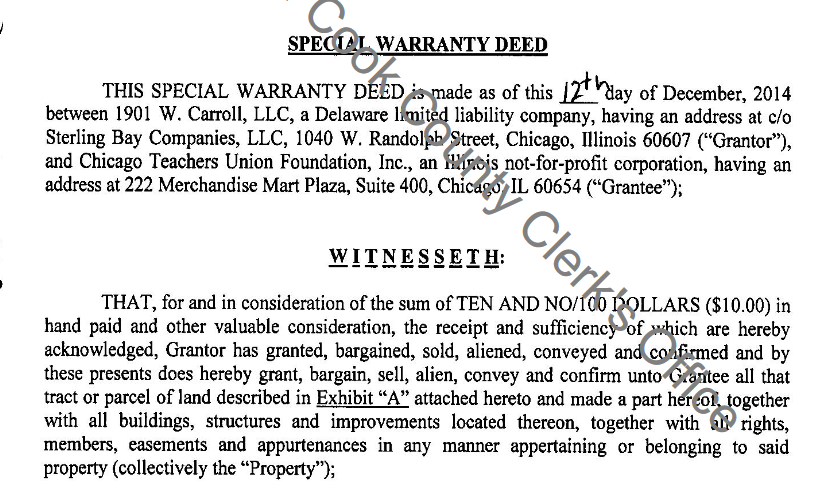

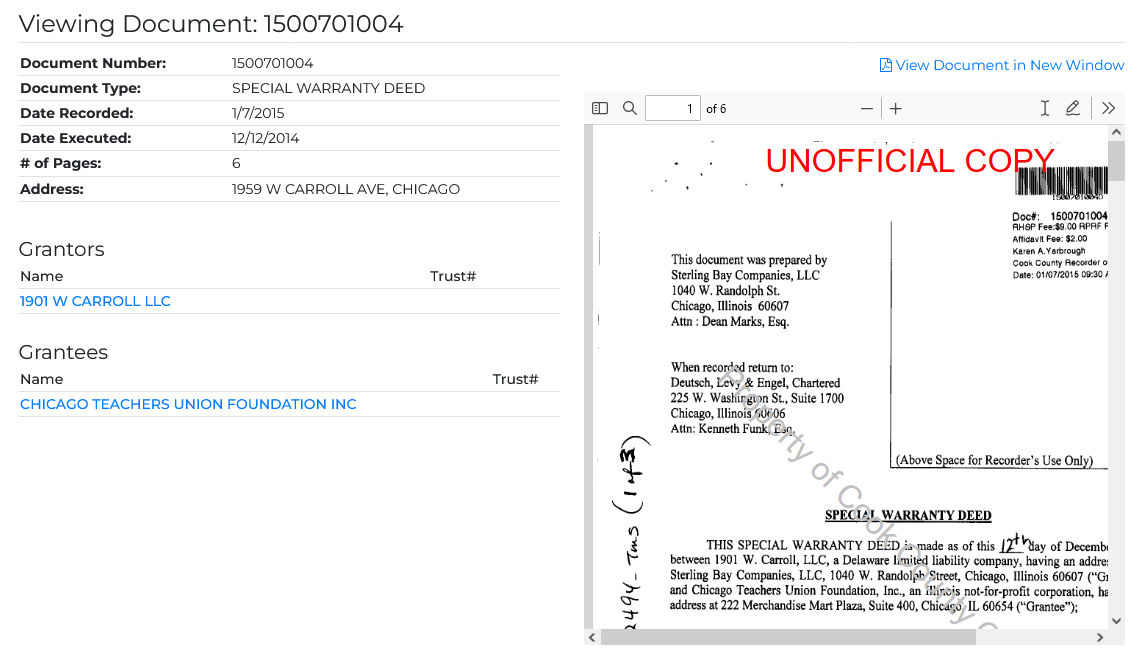

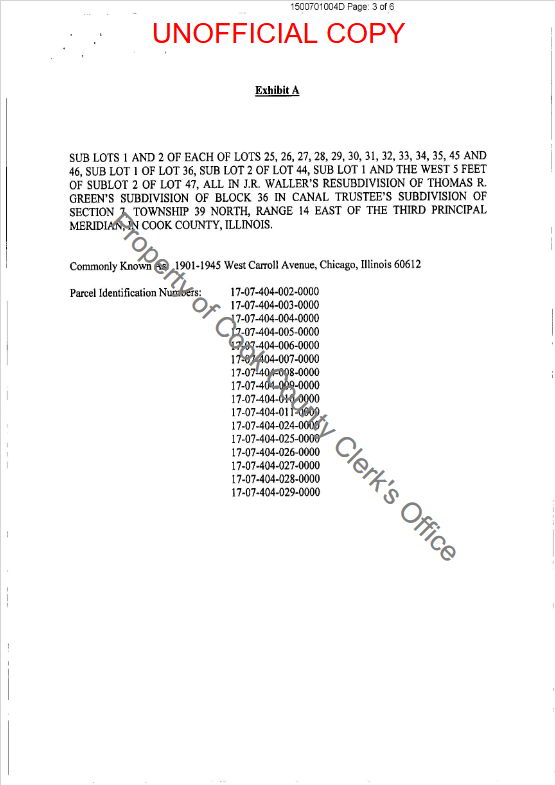

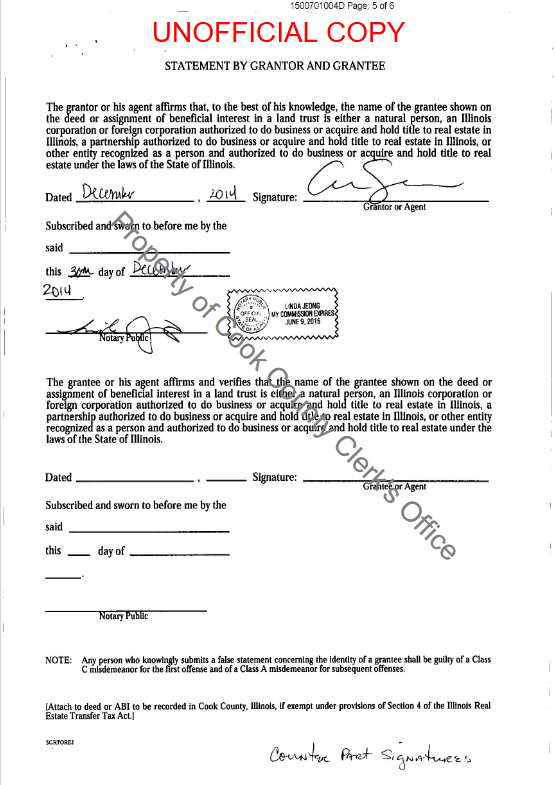

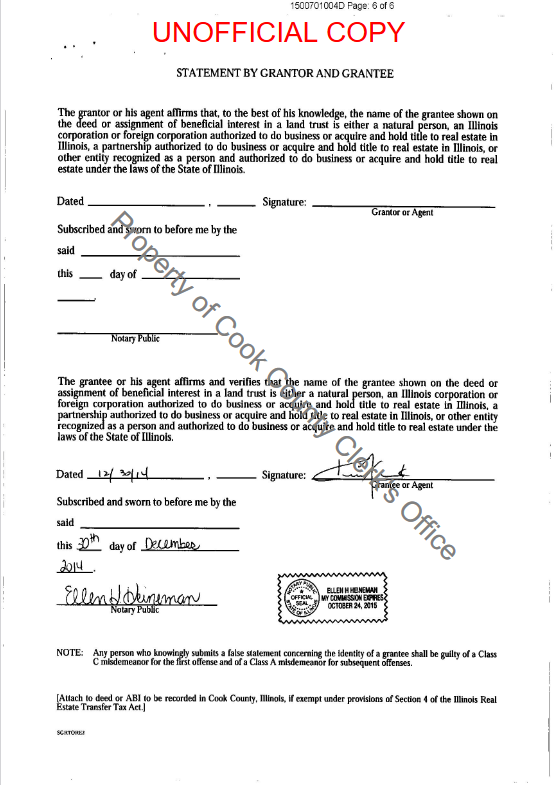

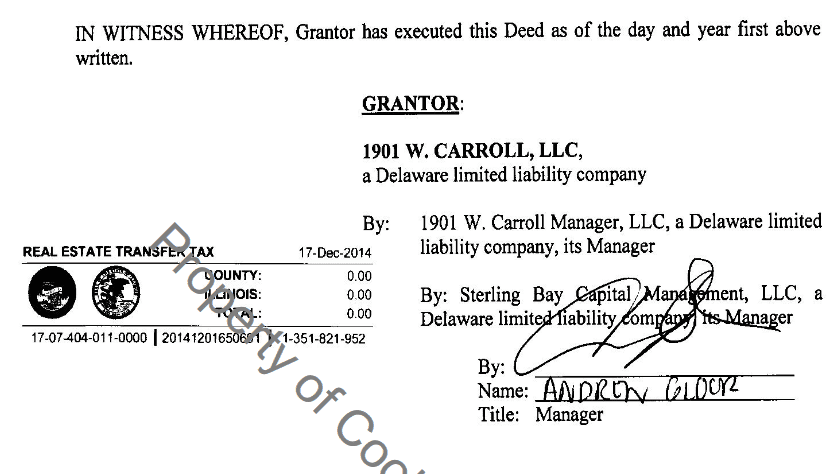

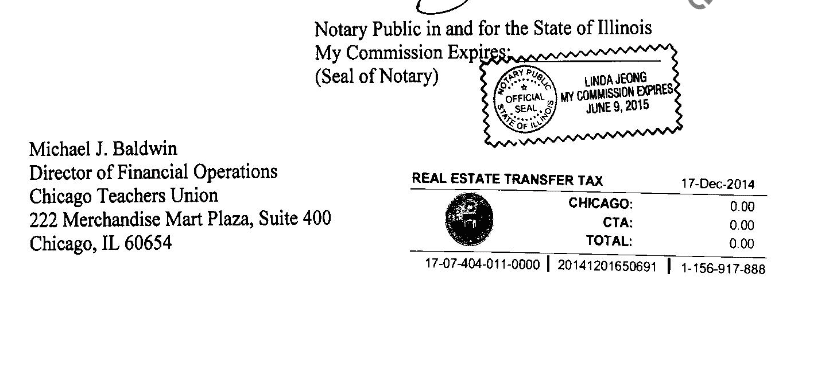

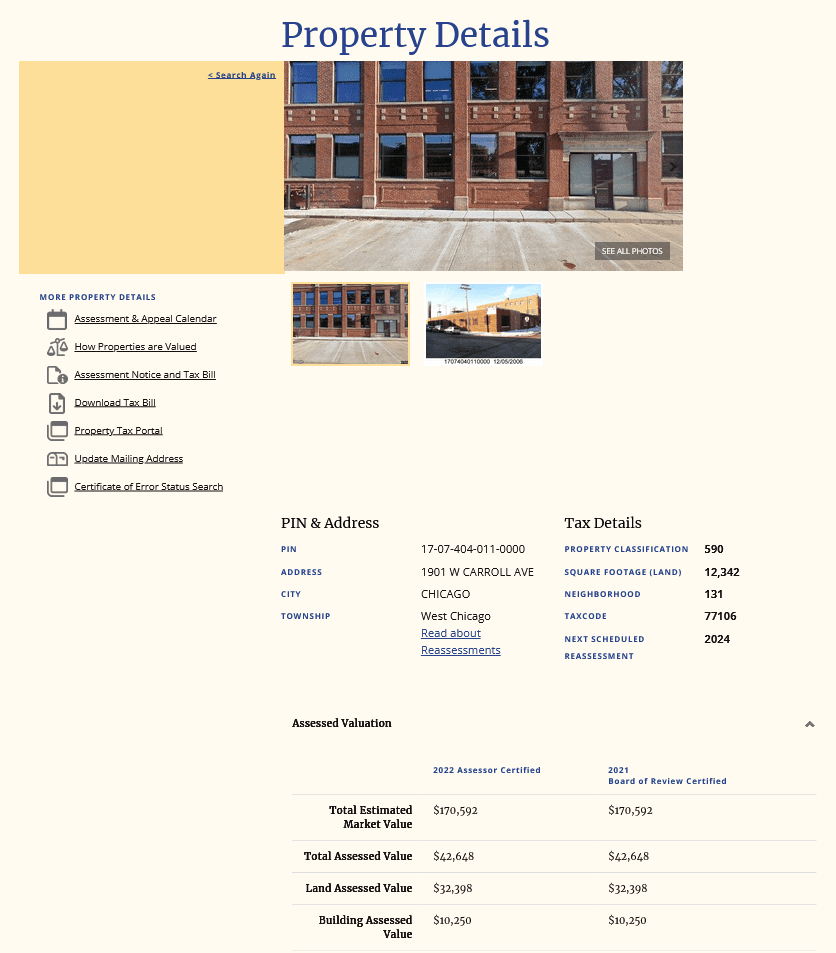

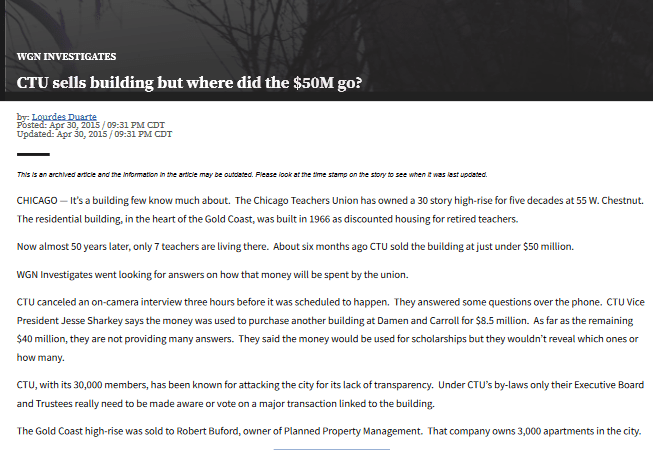

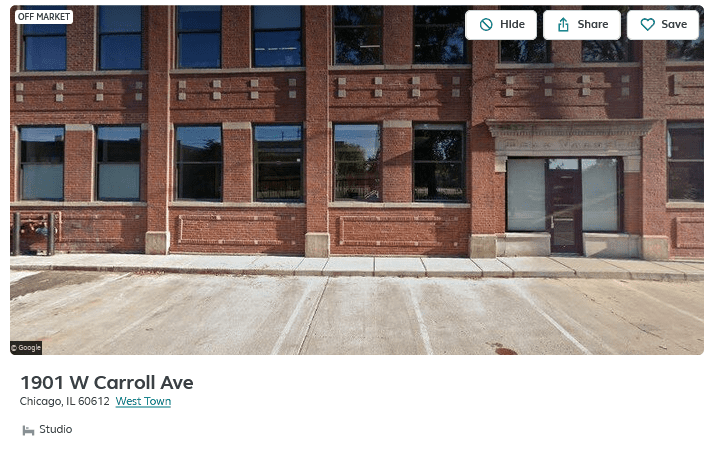

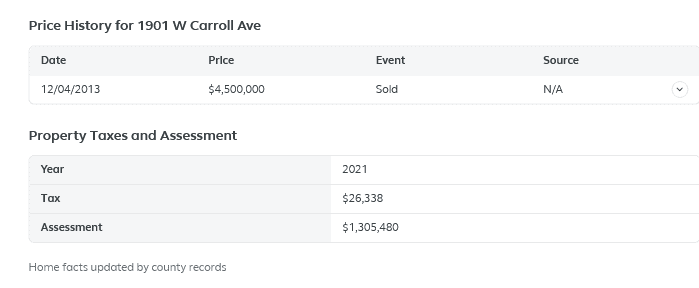

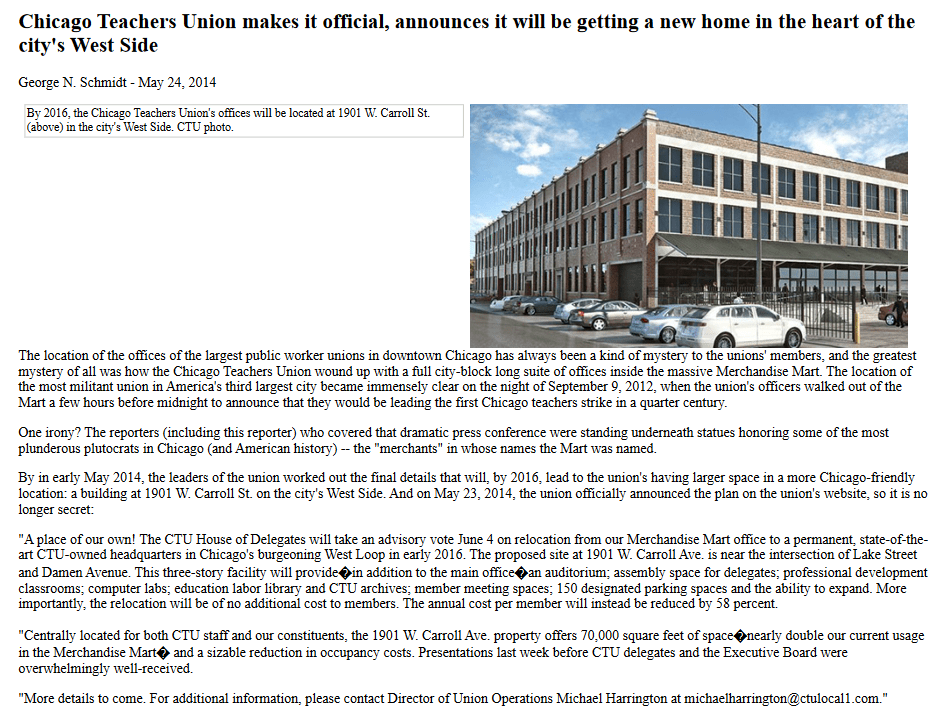

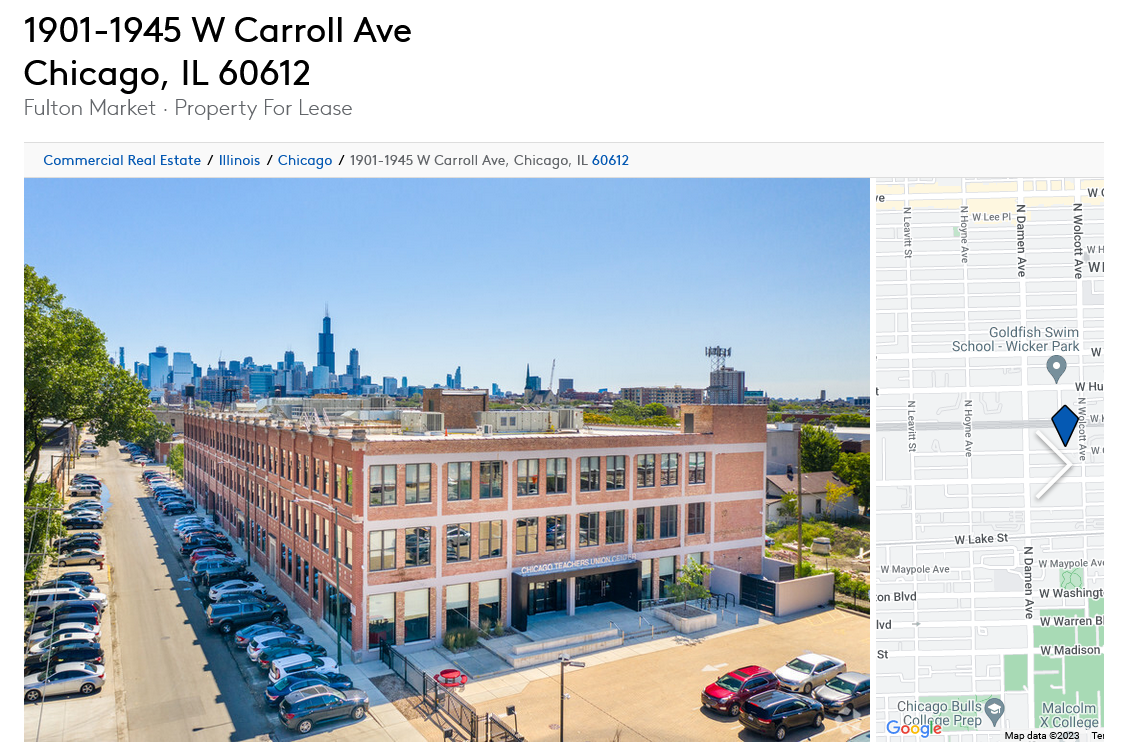

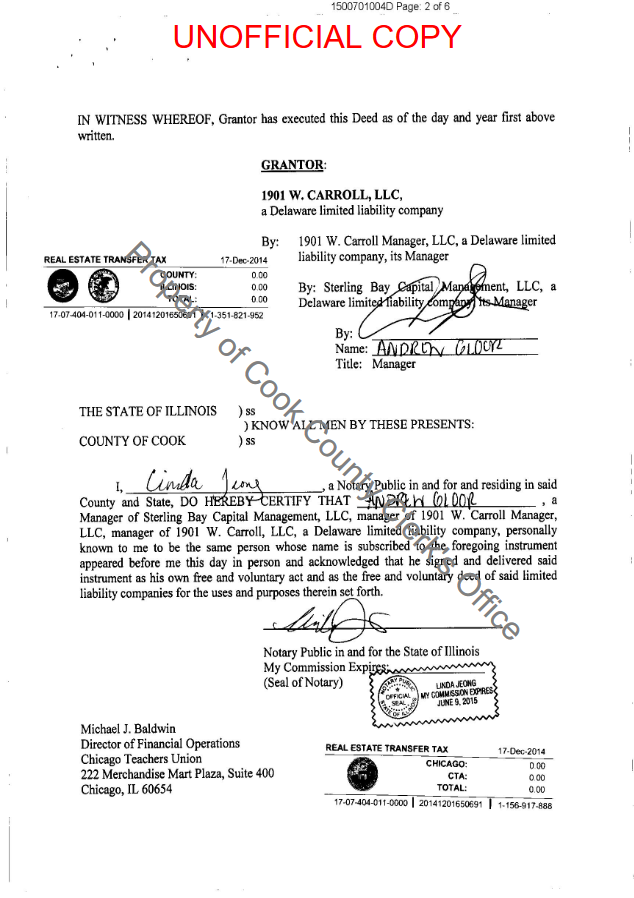

Warranty Deed Document Number 1500701004 shows Sterling Bay sold the property at 1901 West Carroll for $10 to the Chicago Teachers Union on December 12, 2014. That is the same property the Chicago Teachers Union leadership, the media, and documents show sold for 8.5 million dollars.

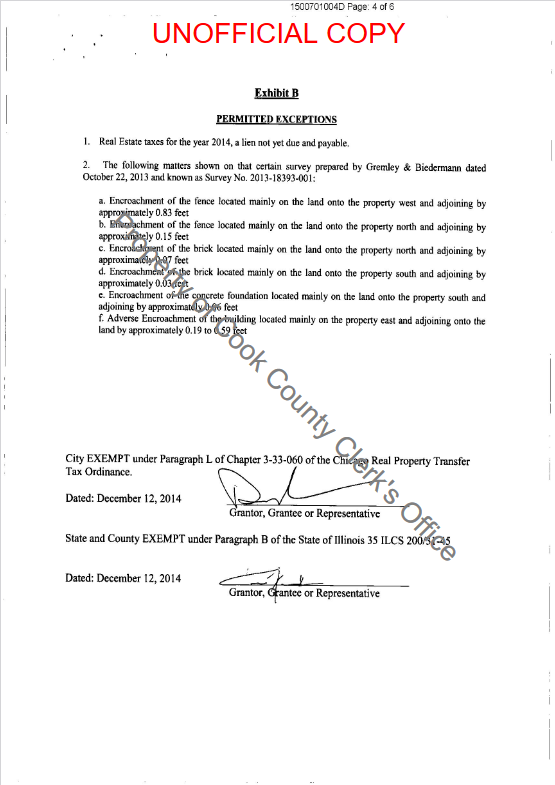

The special warranty deed indicates that CTU and Sterling Bay paid No City, No County, and No State Taxes on the sale of 1901 West Carrol, the headquarters of the Chicago Teachers Union.

We are talking about a three-story building on an entire city block in one of the fastest gentrifying areas of the city, sold for less than a Chick-fil-A sandwich meal.

The same tax that Brandon Johnson is proposing to increase is the one that the CTU helped Sterling Bay not to pay; the tax will raise $100 million by bumping up the transfer tax exclusively on high-value properties, it says on his campaign website.

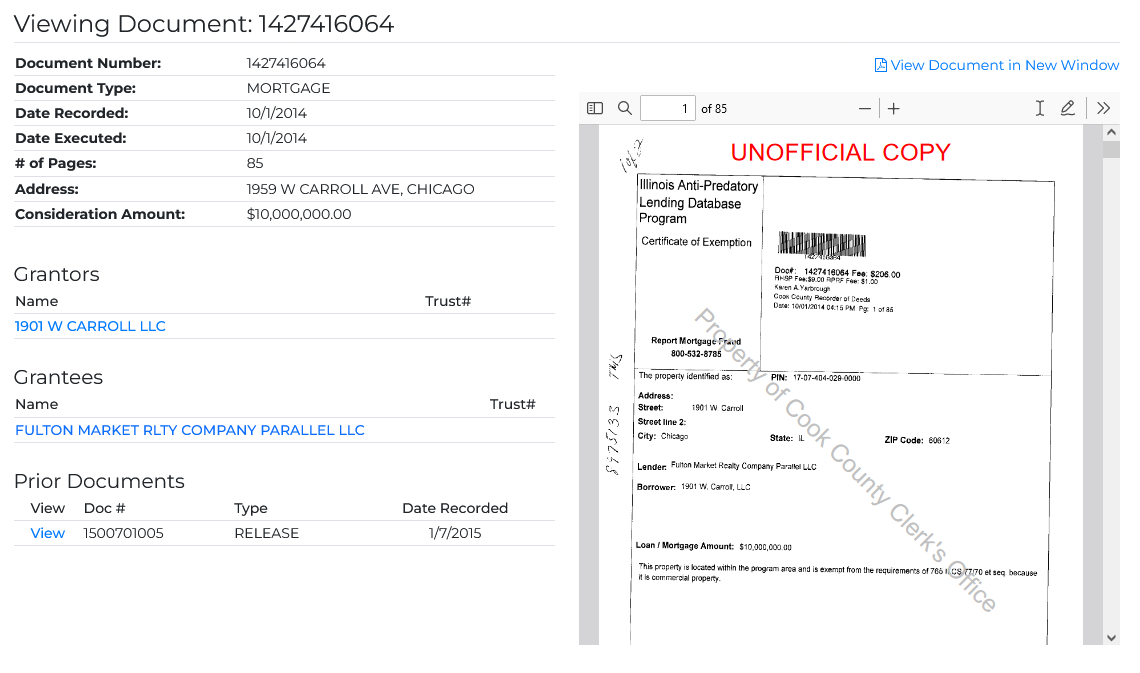

In another document on the recorder of deeds page dated October 1, 2014, there is a mortgage document stating that $10,000,000 was borrowed against the property.

Did the price drop to $10 in two years?

And why would CTU Vice President Jesse Sharkey make public statements about purchasing the building at Damen and Carroll for 8.5 million dollars?

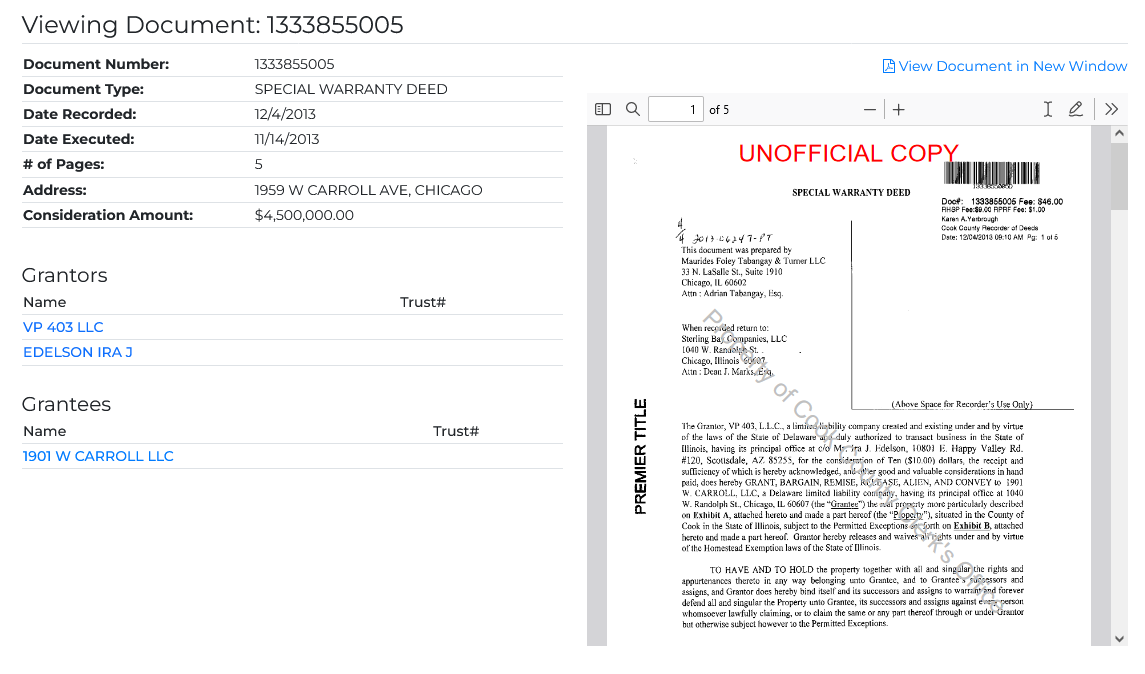

In a Trulia Real estate page, Sterling Bay’s purchase price for 1901 Carroll was 4.5 million two years earlier in December 2013, confirmed by Cook County Clerks Document 1333855005.

We are not tax specialists, but we found another deed for the same property on December 4, 2013, stating that Sterling Bay purchased the property for $10. (Document: 1333855003)

A property that got a mortgage for 10 million and was then purchased for eight and a half million is only worth 10 bucks on official paperwork.

This is some fraudulent shit if I have ever seen any.

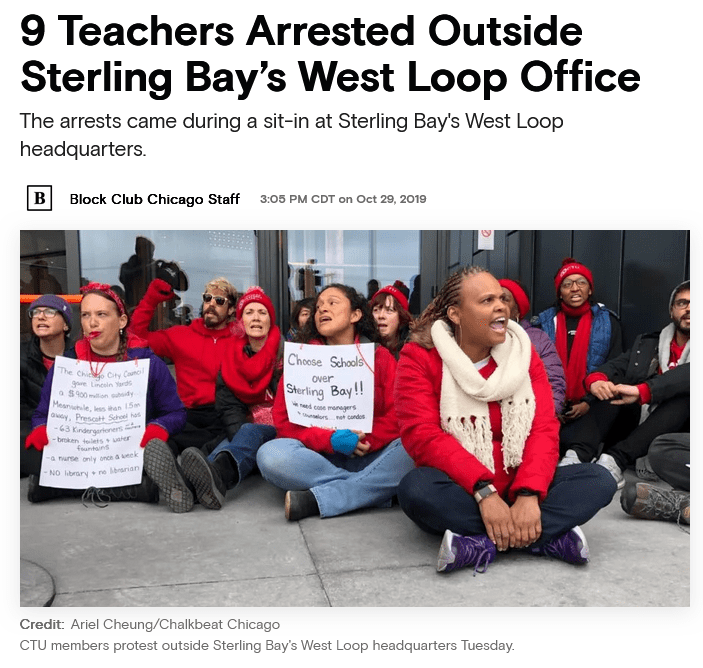

Consorting with the Enemy

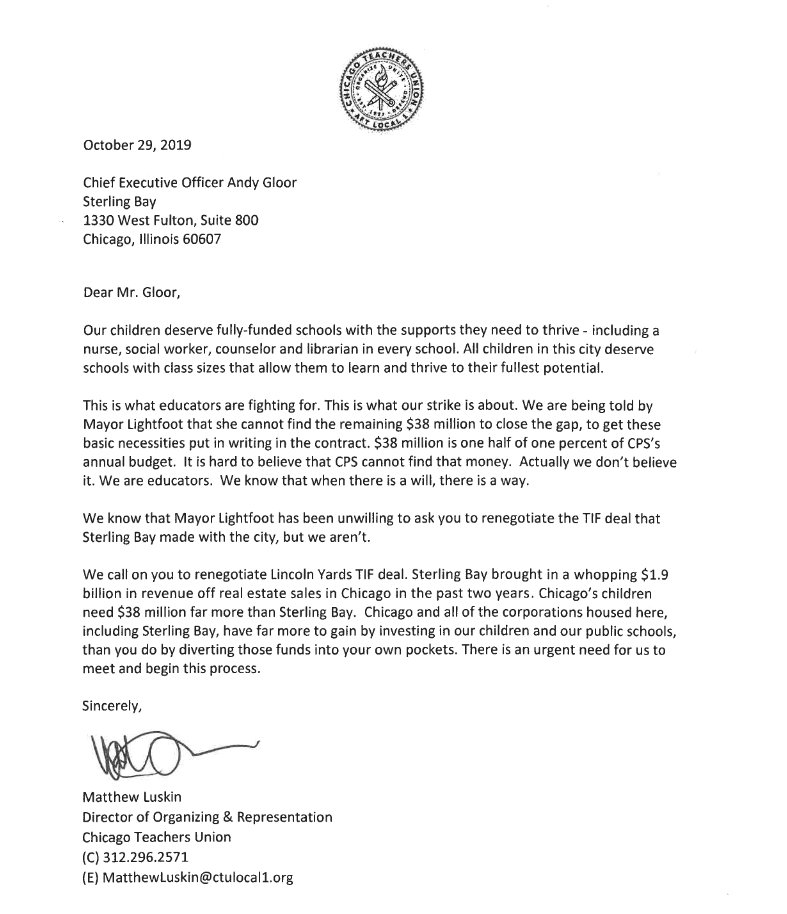

The interesting twist to this tax-dodging story is that Sterling Bay is supposed to be the Union’s archenemy as the evil capitalist developer milking taxpayers dry. The CTU accused Sterling Bay of diverting tax funds into their own pockets in an October 29, 2019 letter.

First, why are you giving Sterling Bay money for anything and, worse, helping them avoid paying transfer and sales taxes on a multi-million-dollar real estate deal?

And who knows, this might be a case of hiding capital gains or real estate income, also.

Consorting with the enemy to defraud the City, County, State, and possibly the Federal government of taxes on a multi-million-dollar real estate deal is something we only see in mob movies.

Yet, the documents don’t tell any lies.

Legal or not, this shows the depravity of the CTU leadership in how they conduct business by lying to the Chicago Teachers Union’s membership and the Chicago taxpayers.

Chicago Teachers Union is defunding Chicago Taxpayers by helping Sterling Bay cheat on transfer taxes.

The same Sterling Bay that the Union says is not paying its fair share of taxes to pay for schools:

“We are targeting Lincoln Yards because it’s being funded in part by TIF money that should be going to our schools,” CTU said in a statement.

Nine Chicago Teachers Union protesters were arrested … during a CTU sit-in at the developer’s building. Teachers earlier in the day protested at the site of Sterling Bay’s unbuilt megaproject Lincoln Yards, arguing tax increment financing dollars being spent for the project should go to education. (Block Club Chicago, October 29, 2019)

The unions were unafraid to target capitalist enemies by name, in this case the real-estate developers and their massive city subsidies. Like the six DSA members who now sit on the city council (and denounced the mayor in a Chicago Sun-Times op-ed), the teachers drew connections between austerity in schools and the lavish grants bestowed on developers with little discussion or debate. On consecutive days, the unions converged at the planned sites for Lincoln Yards and the 78, two luxury residential developments due to receive $2 billion in public money. It feels odd to see protestors convening at what are mostly vacant lots and abandoned buildings, but it’s a reminder that the city has repeatedly placed the prospective future of the wealthy above the present needs of its most marginalized residents.

Following the Lincoln Yards rally, the CTU protested outside the offices of its developer, Sterling Bay. Chicago police arrested nine union members. Activists have alleged that Sterling Bay gamed the definitions of “blight” in order to secure its mammoth funding, and Lincoln Yards was a top priority for Emanuel that Lightfoot seems intent on protecting. By calling out real-estate developers and the government that serves them, the CTU is driving the debate over affordable housing and how the city spends its money. (Jacobin, November 1, 2019)

The CTU is helping Sterling Bay game the system against the taxpayers that pay their salaries.

They are gaming the system against the parents who trust them, to be honest.

They are gaming the system not to pay their fair share.

We would contact CTU for comment, but this reporter has been threatened with legal action if any CTU staff are contacted.

Hence, we publish our investigative findings hoping for public clarification or comment from the CTU Leadership.

Fool me once, shame on you; Fool me twice, shame on me.

—-

… we reposted this article since Sterling Bay is now asking retired Chicago Teachers for $300M for its Lincoln Yards project they once protested …

—-

Sterling Bay seeks $300M from Chicago teachers fund to kickstart Lincoln Yards … Development firm requested an additional $25M from current investors

JUN 7, 2023, 5:46 PM

By Quinn Donoghue

Sterling Bay has turned to the Chicago Teachers Pension Fund to help pick up the pace of Lincoln Yards at a crucial time for the megadevelopment, a deal that, if it comes together, could hurt the project’s initial investors.

The $6 billion mixed-use project has moved sluggishly since being approved in 2019. Now, the developer is seeking funds from the CTPF’s investment committee to kickstart Lincoln Yards, which could lead to losses for the original investors behind the bold 53-acre, 14.5-million-square-foot development, Crain’s reported.

Sterling Bay CEO Andy Gloor recently presented a proposal to the committee, suggesting an investment between $100 and $150 per square foot, amounting to over $300 million. This would replace the current financial backers at discounted rates and revitalize the project that would potentially generate billions of dollars in tax revenue for the city.

The developer wants to consolidate ownership of the Lincoln Yards site, find a new capital partner and resolve a $126 million mortgage tied to a large portion of the property. While Sterling Bay seeks new capital partners, it’s also reaching out to its existing investors for additional funding. The company is aiming to secure $25 million in new equity through an “annex fund” from the current investors.

If CTFP ultimately becomes the primary financial partner, it would be a surprising collaboration, given that the Chicago Teachers Union, whose members have been among the most vocal opponents of Lincoln Yards, has a lot of influence over CTPF.

In Gloor’s pitch, he said, “It’s an unbelievable, generational opportunity to invest in the city” and called it “the most important deal we’ve ever done with Sterling Bay,” the outlet reported.

Sterling Bay faces other financial strains within its portfolio, including a possible forced sale of the Groupon headquarters building and loan issues with the Prudential Plaza complex. But the financial strains posed against Lincoln Yards, which is poised to transform the North Side area for years to come, marks the developer’s biggest challenge to date.

The involvement and support of new Mayor Brandon Johnson — a former Chicago Public School teacher and paid CTU organizer — also remains to be seen, further clouding the project’s future.

—–

Sterling Bay asks Chicago Teachers’ Pension Fund to rescue Lincoln Yards

By Danny Ecker

June 07, 2023 02:12 PM

Sterling Bay is trying to strike a deal with the Chicago Teachers’ Pension Fund to bail out Lincoln Yards, a move that could help jump-start the stalled North Side megadevelopment, inflict hefty losses on the original backers of the ambitious $6 billion project and offer the developer a lifeline amid a financial storm that threatens its control over major pieces of its high-profile local portfolio.

With the real estate firm under growing pressure to raise money to recapitalize the 53-acre mixed-use campus planned along the Chicago River between Lincoln Park and Bucktown, the pension fund’s investment committee voted during a May 23 meeting to investigate an opportunity to become Sterling Bay’s primary financial partner on the development, according to a video of the public meeting and investor documents obtained by Crain’s.

Sterling Bay exec’s goal: Help minority-owned businesses grow

The pitch to the $12.1 billion fund, as laid out during the meeting by Sterling Bay CEO Andy Gloor: Buy into Lincoln Yards at between $100 and $150 per square foot — potentially a more than $300 million commitment — to replace the project’s existing financial backers at steep discounts and help inject life into a stagnant project that could generate billions of dollars in new tax revenue for the city over the next couple decades.

The fundraising push comes as Sterling Bay grapples with financing issues not only at Lincoln Yards, but also at a series of properties it has amassed en route to becoming one of the city’s most prominent real estate firms. Slides that Crain’s obtained from part of an April 26 presentation Sterling Bay made to investors reveal its lender could force a sale of the Groupon headquarters building along the Chicago River, and a loan challenge lies ahead for the two-tower Prudential Plaza complex overlooking Millennium Park.

The documents also reveal the developer’s effort to “consolidate” ownership of the sprawling Lincoln Yards site by finding a new primary capital partner and working out a resolution with a lender that holds a $126 million mortgage — which is set to mature on June 20 — tied to a large portion of the site, according to the presentation.

It adds up to the most serious challenge faced to date for Sterling Bay, which rose to prominence since the Great Recession from an upstart development firm with a knack for modernizing vintage West Loop office buildings into a far larger company with trophy office properties and national expansion aspirations. At stake in the turbulence is the fate of one of the most ambitious planned developments in the city’s history: Lincoln Yards, a 14.5-million-square-foot project meant to reshape a swath of the city’s North Side with high-rises and generate thousands of new jobs.

Sterling Bay’s pitch to the Chicago Teachers’ Pension Fund also tees up the possibility of an unlikely bedfellow on the project. The CTPF invests on behalf of and is highly influenced by the Chicago Teachers Union, whose members have been among the most vocal opponents of Lincoln Yards and a city-approved deal to reimburse Sterling Bay for up to $1.3 billion in new infrastructure tied to the project using tax-increment financing money.

“It’s an unbelievable, generational opportunity to invest in the city,” Gloor told members of the CTPF investment committee during the May 23 meeting, where he called Lincoln Yards “the most important deal we’ve ever done with Sterling Bay.” Gloor presented alongside a locally based executive for Toronto-based Manulife Investment Management, revealed during the meeting to be a new development partner with Sterling Bay on Lincoln Yards.

Sign up for our Commercial Real Estate Report newsletter for exclusive news and analysis right in your inbox.

CTPF Chief Investment Officer Fernando Vinzons said in a statement to Crain’s that the discussions around Lincoln Yards are only “conceptual at this point” and that the investment committee would still need to recommend the Lincoln Yards deal to its board of trustees, which would ultimately have to sign off on any funding commitment, a process that could take months.

In the meantime, Sterling Bay is trying to tap its own investors for more money. A question-and-answer portion of the April presentation shows the developer is seeking $25 million in new equity for an “annex fund” from existing investors in Lincoln Yards, which would supplement the investment it would get from CTPF or another capital partner.

The financial crunch for Lincoln Yards and other high-profile Chicago properties discussed in the presentation isn’t unique to Sterling Bay. Many commercial property owners across the city — particularly those in the office sector — are reeling from a remote work movement that has hammered demand for workspace and whittled foot traffic in Chicago’s urban core. High interest rates, meanwhile, have driven down property values and made it difficult for owners to refinance buildings, forcing many to scramble for new equity partners and prompting a growing number to surrender properties to their lenders or face foreclosure lawsuits.

But the presentation shows such financial stress on a big scale locally for Sterling Bay, lifting the hood on the developer’s Sterling Bay Capital Partners II fund. A “significant portion” of that fund’s equity and future returns are tied to Lincoln Yards, the presentation says.

The fund, which finished raising money in 2016, has investments in a series of Chicago properties including several Lincoln Yards parcels; Groupon’s HQ building, at 600 W. Chicago Ave.; Prudential Plaza; and office buildings at 333 and 360 N. Green St. and 311 W. Monroe St., the documents show. The presentation also shows the fund backs the mixed-use apartment and hotel tower Sterling Bay completed last year at 300 N. Michigan Ave. and an apartment building under construction at 160 N. Morgan St. in the Fulton Market District.

Questions and answers in the document — which came in response to a presentation during the virtual meeting with investors in April — paint a picture of a fund grappling with financial strain while Sterling Bay seeks ways to generate liquidity to avoid defaulting on loans, maintain confidence of its existing investors and convince them to double down on properties moving forward.

Challenges appear steepest at Lincoln Yards, the project that signaled Sterling Bay’s bold growth plans when the developer unveiled its vision for the campus in July 2018. The proposal, supported by then-Mayor Rahm Emanuel, would include a mix of offices, residential units, retail and other uses, as well as towers rising as high as 595 feet. Sterling Bay estimated at the time that it would generate 24,000 permanent jobs and a massive tax boon to a city battling fiscal woes. Just before Emanuel left office in 2019, the City Council signed off on the project, as well as the controversial plan to create a new tax-increment financing district to support it: Property tax gains generated by the project in the future are slated to help repay Sterling Bay for infrastructure costs.

Sterling Bay spent more than $250 million between 2015 and 2017 acquiring the largest pieces of a once-bustling riverfront industrial corridor to make room for the megaproject, according to Cook County property records. Along with the Sterling Bay fund, which holds a relatively small equity piece of the properties, two primary financial partners originally backed the developer on the proposed campus: New York-based J.P. Morgan Asset Management on the southern portion, and Dallas-based Lone Star Funds on the northern portion.

But since winning City Council approval for the project in 2019, Sterling Bay has built just one building on the southern portion of the site — an empty life sciences lab property at 1229 W. Concord Place — and has yet to begin major infrastructure work needed to kick-start other development there. In the presentation, Sterling Bay cited “market conditions” for holding back the project and also pointed to city officials as an obstacle. “There was a significant degree of uncertainty relative to approvals from the city of Chicago that could influence our ability to execute a business plan,” one response to an investor question said.

Gloor has publicly blamed former Mayor Lori Lightfoot for setting back the project by delaying permits and other city approvals needed to finance new roads and other infrastructure. He reiterated that gripe to the CTPF, saying the infrastructure “needed collaboration (from City Hall) to start . . . . and we just couldn’t get in lock-step.”

Regardless of what has slowed progress, the presentation shows Lincoln Yards becoming a financial quandary for Sterling Bay with no clear end in sight, and with its control of the project’s future potentially in question. Sources familiar with the matter say Lone Star and J.P. Morgan are prepared to sell their stakes at a substantial discount, signaling their waning patience with the development’s path forward. Lone Star declined to comment, and J.P. Morgan didn’t address questions about the project.

Adding to the financial pressure: There are “no further extensions available” on the $126 million loan from Little Rock Ark.-based lender Bank OZK tied to a large chunk of the property’s northern portion slated to mature this month, according to an investor document. A chart in the presentation notes Sterling Bay aims to get Bank OZK to “participate” in the consolidation of Lincoln Yards ownership by finding a new capital partner to back its Lone Star buyout, then “recast” the loan under that new venture, likely meaning it would start a new clock on the mortgage’s maturity date.

If Sterling Bay can’t pull off such a deal, Bank OZK could be in position to seize control of the property. It’s unclear how the lender might proceed with Sterling Bay, a development partner it has backed on other prominent Chicago projects including 300 N. Michigan and 360 N. Green. Bank OZK didn’t address questions about Lincoln Yards.

Sterling Bay will need to convince the CTPF or another new capital partner to not only assume the cost of carrying the land, but potentially commit to helping finance infrastructure and future buildings on the site. That could prove difficult amid economic uncertainty and many investors wary of taking on a massive commercial project in Chicago.

There’s little clarity on when or if the project will begin to see more activity and what role new Mayor Brandon Johnson —a former Chicago Public School teacher and paid CTU organizer — will play in helping Sterling Bay forge ahead. Gloor told the CTPF that his group has “been in regular communication with Mayor Johnson’s administration…. They’re enthusiastically in favor of the development. They understand the economic benefits to the entire city of Chicago and the jobs. We didn’t have that type of communication (with Lightfoot), but we do now. So we do not anticipate any delays.”

Jason Lee, a senior advisor to Johnson, confirmed that the administration has had “several conversations” with Sterling Bay and Gloor, saying open dialogue is the “philosophy of our administration.”

Lee said the conversations were not about Lincoln Yards specifically, but rather the “challenges that large development projects have in the city and some ideas to align on goals to create more equitable development and affordable housing opportunities through small and large developments.”

Sterling Bay is playing up the local angle in its bid for fresh capital. In a statement, the firm says “(a) Chicago-based investor is the right partner to help us bring all these opportunities, and more, to life at Lincoln Yards. As Mayor Johnson stated in his inaugural address, ‘Together, we can build a better, stronger, safer Chicago,’ and we believe that developments like Lincoln Yards, which stand ready to build a brighter future for our city, are how we win together as Chicagoans.”

The presentation shows additional loan deadlines are looming for the fund on smaller Lincoln Yards parcels. Properties at 1907 N. Mendell St. and at the intersection of Elston Avenue and Cortland Street — near the Metra station where Sterling Bay aims to eventually develop a multi-modal transit hub for Lincoln Yards — each have relatively small mortgages from Signature Bank that were due to mature in May but were recently extended to Nov. 2, according to the presentation.

New York-based Signature Bank, which failed in March and subsequently had its deposits assumed by New York Community Bancorp, “is willing to extend” the maturity beyond November, the presentation said. A chart in the document said Sterling Bay’s plans for the parcels would be to pursue a “3rd party sale if possible or potentially sell to the (Lincoln Yards) consolidated venture.” NYC Bancorp didn’t address questions.

Sterling Bay also disclosed in the documents that, while it expects the fund to be involved in several development projects at Lincoln Yards, some parcels “will likely be sold to third-party developers” to construct buildings.

Sterling Bay frames its push to raise money for Lincoln Yards as a great opportunity to buy in at remarkably low values and, therefore, get higher returns if the developer can execute its vision for the project. That sales pitch, however, acknowledges the dramatic loss of value in properties owned by the fund.

“The reduced basis in each of these investments present very compelling return profiles that are appealing to prospective investors,” Sterling Bay wrote in a response to a question in the document. “(Sterling Bay) believes we can overcome concerns surrounding investment in Chicago office property given the attractive basis and compelling economics.”

Sterling Bay’s investor documents also show the developer expects it will need far more time to return the money to its fund investors than it initially anticipated. The fund’s initial term was 10 years with two one-year extension options that would push its expiration to Feb. 2028, according to the presentation, but the developer projects the life of the fund “may need to be extended through Q3 2031 for final disposition of all investments.” The size of the fund is not clear, but a Sterling Bay spokeswoman previously said the developer had raised between $90 million and $200 million for the fund.

In the meantime, Sterling Bay is doing what it can to shore up the fund.The developer’s partners recently put up $3.5 million “to maintain compliance with certain ongoing debt covenants,” the document said. Sterling Bay also deferred its asset management fee at the fund “to provide liquidity,” according to the presentation.

Another big revelation in the presentation involves the riverfront office property at 600 W. Chicago Ave, the Groupon-anchored, 1.6 million-square-foot building. A joint venture of Sterling Bay and J.P. Morgan bought the former Montgomery Ward catalog building in 2018 for $510 million.

The venture financed that acquisition with a nearly $428 million debt package that matured in March, according to the presentation. The debt includes a $374 million senior loan from Morgan Stanley, with the remainder provided as mezzanine debt from TIAA-CREF, according to research firm MSCI Real Assets.

Severely weakened demand for workspace, high interest rates and a reluctance among banks to provide new loans on office properties have likely prevented Sterling Bay from being able to refinance the building. As of the April 26 presentation, the developer was “working on approval for extension” of the loan through 2023, which would include “placing the property deed in escrow for benefit of the lenders.” The lender group, the documents said, could require that the building goes up for sale, but the Sterling Bay fund would “seek to buy back the property at a discount.”

Speaking to Crain’s yesterday about the investor document, Gloor said he expects Morgan Stanley to go through “pricing discovery” but not formally market it to buyers. “They’re trying to understand what the real value is.”

Morgan Stanley declined to comment.

Struggling online-deal company Groupon recently disclosed it would pay $9.6 million to terminate its nearly 300,000-square-foot lease in January, two years earlier than its deal was scheduled to expire. The building is 96% leased today, according to real estate information company CoStar Group, but losing Groupon stands to push occupancy below 80%.

The fund faces another looming loan challenge at Prudential Plaza, where it is a minority investor in a venture led by Wanxiang America Real Estate that acquired the property in 2018 for $680 million.

Wanxiang said in a statement it will seek an extension of a $389 million mortgage tied to the buildings that doesn’t mature until August 2025 to “better position ownership, and the asset, for the future.”

Ownership “intends to invest significant capital over the next several years to secure existing and new tenants while also improving the building’s amenities and common areas,” the statement said. For Sterling Bay fund investors, that could mean a future call for more money to help renovate the property and stabilize its tenant roster.

Meanwhile, the Sterling Bay document also shows the developer plans to sell office buildings at 333 N. Green and 311 W. Monroe, but only after it re-leases space currently occupied by meeting space and co-working company Convene. The New York-based firm signed leases in 2019 to occupy roughly 185,000 square feet combined in the two buildings and still operates the locations today, though terms of the leases are not clear. Convene declined to comment.

Sterling Bay hired brokers to sell the Green Street building last year, but the property never traded. Gloor said prospective buyers put little value in space leased to a meeting space operator, and “we’re trying to limit our exposure as much as possible so we can increase the value” of the properties.

Sterling Bay also said during the CTPF presentation that it plans to move its own headquarters out of 333 N. Green to the first office building developed at Lincoln Yards. The developer occupies just more than 31,000 square feet in the 19-story Green Street building, according to CoStar.

The presentation shows Sterling Bay’s $155.7 million outstanding loan balance on 311 W. Monroe includes a $10 million guaranty that the fund is on the hook to pay if there is an event of default or if the building is sold for less than the balance of the loan.

Sterling Bay also intends to sell the residential portion of 300 N. Michigan by the end of this year, according to the presentation. The firm in October sold the 10-story CitizenM hotel in the building for $74 million to the Dutch hotel brand itself under a deal that was pre-negotiated when the $250 million, 47-story tower was being built.

The presentation shows the developer has $120.5 million in outstanding debt on the Michigan Avenue property. Bank OZK is the senior lender on the mortgage, which is due to mature in July 2024.

Sterling Bay has still pulled off some victories amid the financial challenges. It defied the workspace-shedding woes brought on during the COVID-19 pandemic by notching leasing wins at its projects in the Fulton Market District, which it helped transform during the past decade from a meatpacking neighborhood into a trendy destination for major office users including Google and McDonald’s.

Most recently, the developer has been in advanced talks to sign a 90,000-square-foot lease with law firm Greenberg Traurig at the building under construction at 360 N. Green. That deal would add to an anchor tenant lease Sterling Bay previously signed with Boston Consulting Group and would bring the building to more than two-thirds leased before it’s even completed.

Crain’s reporter Justin Laurence contributed.

https://www.chicagobusiness.com/commercial-real-estate/sterling-bay-chicago-teachers-pension-fund-lincoln-yards

Sources for Report

$10 – Warranty Deed Dec 12, 2014 – 1901 W. Carroll – Document: 1500701004

$10,000,000 Mortgage – October 1, 2014 – 1901 W. Carroll – Document: 1427416064

https://crs.cookcountyclerkil.gov/Document/DisplayPdf?dId=MTQyNzQxNjA2NA2&hId=MTFlN2RiNzFkMDQ2YmNmMTQ3MTE0N2MwOWJkZTA0NzdkODE5NDNhZDNmNDNhNTc3OGFjMjI5ZTk0YWFiYjQ0OA2

$4,500,000 – Special Warranty Deed Nov 14, 2013 – 1901 W. Carroll – Document: 1333855005

https://crs.cookcountyclerkil.gov/Document/Detail?dId=NDIxOTk0NTI1&hId=ZDgyZjg4YzI3MjcwODRjMmZhNjFjMDM3ZmE1MzVmOTg4YjM0N2UwNjU2OTUzN2ZiMGE3Zjk3YjUwZDFlZTk4Nw2

Property Details 17-07-404-011-0000 1901 W CARROLL AVE CHICAGO, IL West Chicago PIN Details Cook County Assessor’s Office

https://www.cookcountyassessor.com/pin/17074040110000

CTU sells building but where did the $50M go? by Lourdes Duarte Posted: Apr 30, 2015 / 09:31 PM CDT Updated: Apr 30, 2015 / 09:31 PM CDT https://wgntv.com/news/wgn-investigates/ctu-sells-building-but-where-did-the-50m-go/

Trulia Listing 1901 W Carroll Ave Chicago, IL 60612 West Town

https://www.trulia.com/p/il/chicago/1901-w-carroll-ave-chicago-il-60612–2448473991

Chicago Teachers Union makes it official, announces it will be getting a new home in the heart of the city’s West Side George N. Schmidt – May 24, 2014 http://www.substancenews.net/articles.php?page=4997

Protesters Arrested During CTU Demonstration at Sterling Bay Published October 29, 2019 • Updated on October 29, 2019 at 5:14 pm

Several protesters were arrested Tuesday afternoon during a Chicago Teachers Union demonstration at the offices of Sterling Bay, the developer behind the controversial Lincoln Yards project.

The group gathered outside Sterling Bay’s offices around 12:45 p.m., some holding signs that read “Choose Schools over Sterling Bay.”

The protesters argued TIF funds being put toward the massive Lincoln Yards development project should instead be given to schools and teachers.

“We are targeting Lincoln Yards because it’s being funded in part by TIF money that should be going to our schools,” the union wrote in a statement early Tuesday morning. “If Lightfoot wanted to settle the contract TODAY, she would only need to declare an additional TIF surplus to do so. Lincoln Yards got everything it wanted in writing. Why can’t we get everything our students deserve?”

https://www.nbcchicago.com/news/local/ctu-protesters-arrested-during-demonstration-at-sterling-bay/2056281/

Sterling Bay disagrees with you. #lincolnyards #TIF #brokeonpurpose #faircontractnow Chicago Teachers Union @CTULocal1 8:37 AM · Oct 23, 2019

9 Teachers Arrested Outside Sterling Bay’s West Loop Office The arrests came during a sit-in at Sterling Bay’s West Loop headquarters by Block Club Chicago Staff 3:05 PM CDT on Oct 29, 2019

Chicago Teachers Show Again How to Fight and Win By Devin Schiff 11.01.2019 https://jacobin.com/2019/11/chicago-teachers-show-again-how-to-fight-and-win

Following the Lincoln Yards rally, the CTU protested outside the offices of its developer, Sterling Bay. Chicago police arrested nine union members. Activists have alleged that Sterling Bay gamed the definitions of “blight” in order to secure its mammoth funding, and Lincoln Yards was a top priority for Emanuel that Lightfoot seems intent on protecting. By calling out real-estate developers and the government that serves them, the CTU is driving the debate over affordable housing and how the city spends its money. In response, Lightfoot leaned on assertions that the funding can’t be reallocated without significant legal hurdles, but as CTU spokeswoman Chris Geovanis said, “This is a dispute about priorities.” While Lightfoot referred to funding public education as a “bailout” and repeatedly criticized the scope of the CTU’s demands, the union maintained that fostering good schools for every student and employee requires addressing a spectrum of interconnected priorities.

Nine CTU members due in court for arrests at Sterling Bay/Lincoln Yards strike action By CTU Communications | November 27, 2019 https://www.ctulocal1.org/posts/nine-ctu-members-due-in-court-for-arrests-at-sterling-bay-lincoln-yards-strike-action/

Wednesday, Nov. 27, 1 p.m.: Preliminary hearing for nine CTU members

Cook County Criminal Court, 3150 W. Flournoy St., Chicago

Members will hold a press availability immediately after court.

CHICAGO, Nov. 27, 2019—Nine Chicago Teachers Union members are due in Cook County Criminal Court today to face misdemeanor charges for trespassing. The charges stem from a protest and sit-in at the headquarters of developer Sterling Bay during the CTU strike. The act of civil disobedience sought to draw attention to billions of public TIF dollars being awarded to wealthy, clouted developers rather than common good needs like class size enforcement, clean facilities and a librarian in every school.

CTU educators held the sit-in when Sterling Bay executives refused accept a letter calling on the developer to renegotiate the TIF deal the company made with the City.

The courthouse is located at 3150 W. Flournoy St. on Chicago’s West Side. The arrestees, their attorney, community supporters and CTU Vice President Stacy Davis Gates will hold a press availability at the conclusion of the hearing.

Sterling Bay executives refused accept a letter calling on the developer to renegotiate the TIF deal the company made with the City. https://www.ctulocal1.org/wp-content/uploads/2019/11/10-29-19-letter-to-Sterling-Bay-CEO.pdf

Brandon Johnson Plan to Stop Property Taxes

https://www.brandonforchicago.com/issues/city-budget-and-revenue

… this promise has already been broken …

CPS is also issuing its highest-allowed property tax increase of 5%, or about $131 million, to help support its budget. Property taxes are the schools system’s largest revenue source with state funding still falling about $1.4 billion short. But CPS-issued increases – a routine yearly occurrence – have often gone under the radar compared to those at the city level.

https://abc7chicago.com/chicago-public-schools-cps-budget-school-budgets/13378919/

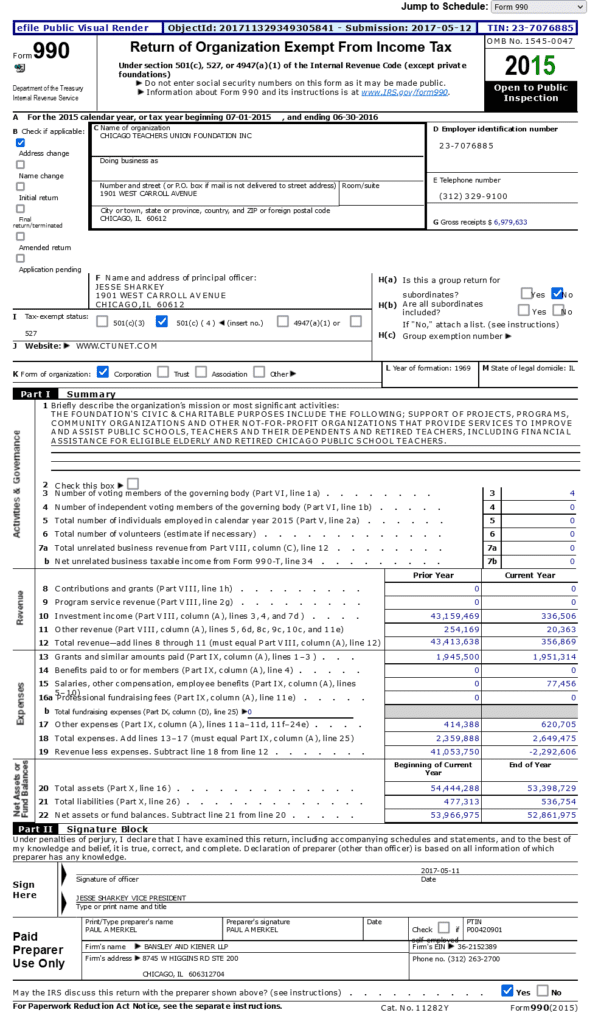

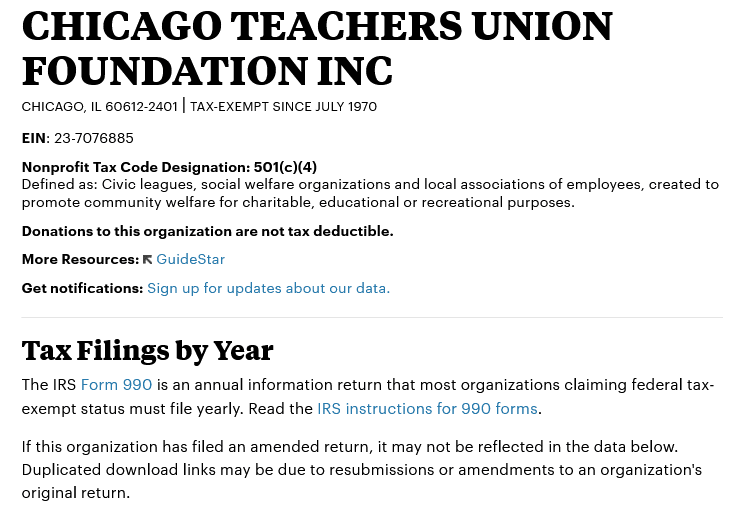

CHICAGO TEACHERS UNION FOUNDATION INC CHICAGO, IL 60612-2401 | Tax-exempt since July 1970 Full text of “Full Filing” for fiscal year ending June 2016

https://projects.propublica.org/nonprofits/organizations/237076885/201711329349305841/full

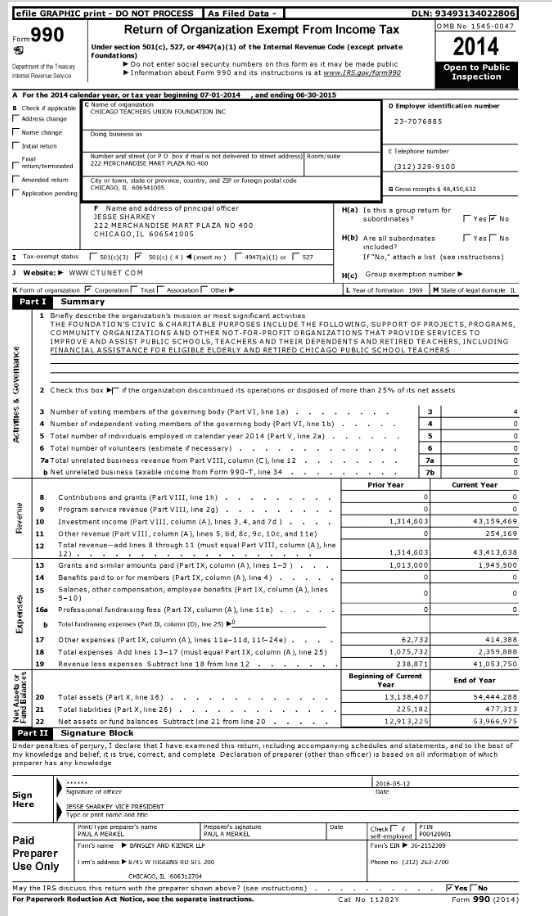

CHICAGO TEACHERS UNION FOUNDATION INC CHICAGO, IL 60612-2401 | Tax-exempt since July 1970 Form 990-O for period ending June 2015 https://projects.propublica.org/nonprofits/display_990/237076885/2016_08_EO%2F23-7076885_990O_201506

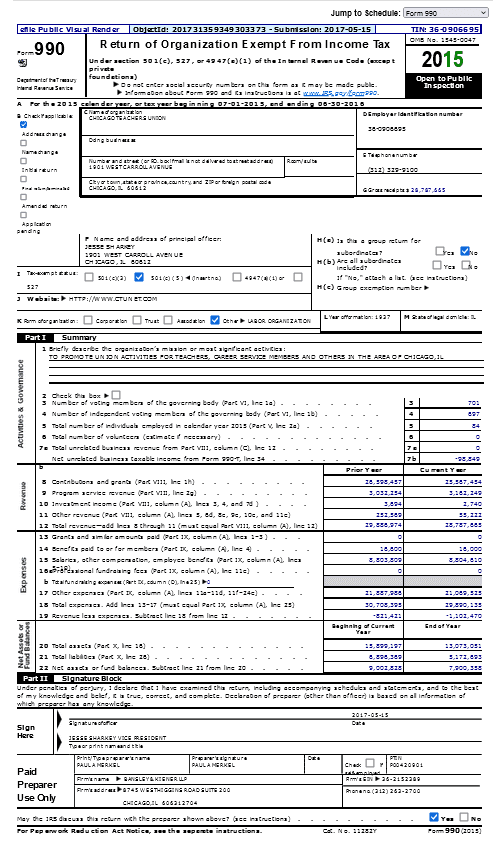

CHICAGO FEDERATION TEACHERS UNION CHICAGO, IL 60612-2401 | Tax-exempt since Aug. 1967 Full text of “Full Filing” for fiscal year ending June 2016

https://projects.propublica.org/nonprofits/organizations/360906695/201731359349303373/full

CHICAGO TEACHERS UNION FOUNDATION INC CHICAGO, IL 60612-2401 | Tax-exempt since July 1970 EIN: 23-7076885 https://projects.propublica.org/nonprofits/organizations/237076885

CHILDREN & TEACHERS FOUNDATION OF THE CHICAGO TEACHERS UNION CHICAGO, IL 60612-2401 | Tax-exempt since April 2015 EIN: 46-5340132 https://projects.propublica.org/nonprofits/organizations/465340132

CHICAGO FEDERATION TEACHERS UNION CHICAGO, IL 60612-2401 | Tax-exempt since Aug. 1967 EIN: 36-0906695 https://projects.propublica.org/nonprofits/organizations/360906695

CTU collaborated with Sterling Bay to avoid paying real estate transfer taxes on an 8.5 million dollar sale of 1901 W. Carroll the CTU Headquarters Building

$10 – Warranty Deed Dec 12, 2014 – 1901 W. 1901 W. Carroll

https://crs.cookcountyclerkil.gov/Document